M1 Finance combines the automation of a robo-advisor with the customization and control of a full-service online brokerage, and the service is free for individual investors. If you are looking to create a diversified investment portfolio, M1 Finance is nearly impossible to beat.

Existing robo-advisors offer fully managed, passive portfolios. After you complete a basic risk tolerance questionnaire at signup, these firms recommend a portfolio comprised of widely-diversified, index ETFs. The recommended portfolio will differ according to each investor’s risk tolerance, but all investors utilize the same index ETFs.

The result is a fairly standardized process, where risk-averse investors own more bonds and risk-tolerant investors maintain significant exposure to stocks. The default asset allocation is maintained for the life of the account through automated rebalancing.

M1 Finance retains some of the best robo-features while allowing investors to customize and control their investment portfolio. Instead of relying on a predefined set of index ETFs, M1 Finance allows the investor to select from thousands of publicly traded stocks and ETFs. The portfolio can be updated and modified at any time, providing flexibility and freedom.

This hybrid approach to investing appeals to both DIY investors and those looking for guidance, and I can confidently say that M1 Finance is one of the most innovative investment companies to emerge this decade.

The M1 Finance Investment Process

Step 1) Create a free account

M1 allows users to create a personalized account and explore the platform without requiring an initial deposit. You can create and customize your entire investment portfolio before transferring any money into your M1 Finance account.

Step 2) Customize your “pie”

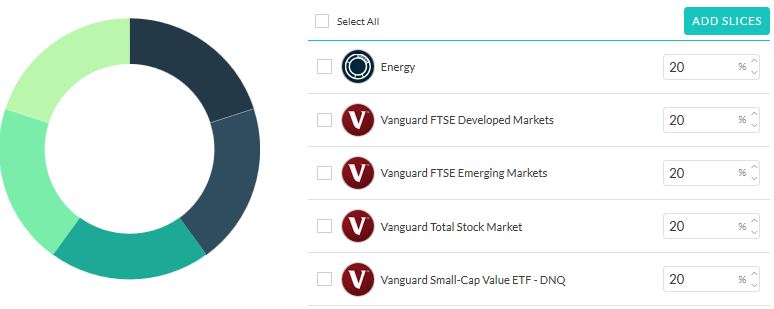

A pie is the basic building block of M1 portfolios.

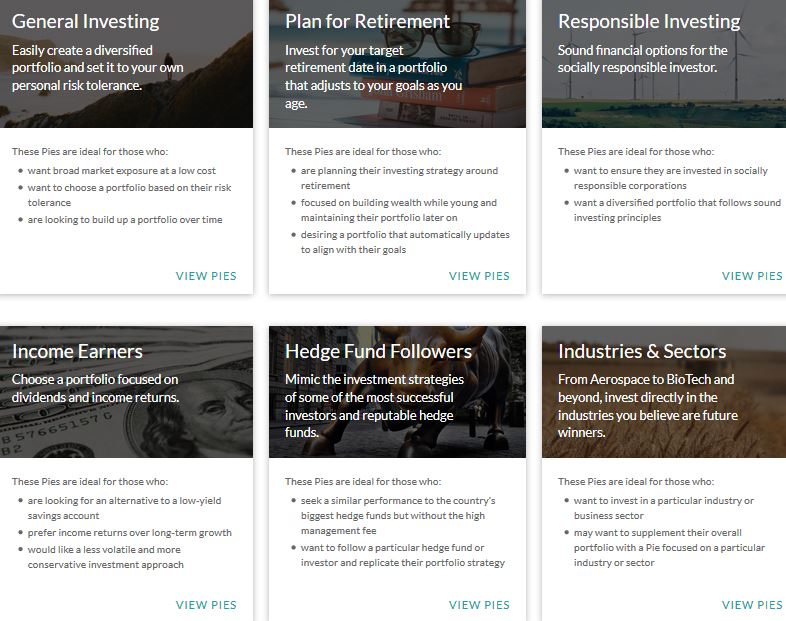

You can select professionally designed M1 pies which are created and updated by the M1 Finance investment committee (no customization allowed). There are a variety of different investment strategies within these pies. For example, M1 offers a group of pies called “general investing” which include the same diversified stock and bond ETFs recommended by other robo-advisors.

You will also find pies that are quite innovative and fun to explore, including pies that represent hedge fund strategies, responsible investment strategies, and individual industries or sectors.

You can also build customized pies using any combination of securities (stocks and ETFs) that are listed on the NYSE or NASDAQ stock exchanges. You can create an unlimited number of pies, and each pie can contain up to 100 stocks and/or ETFs.

This is where M1 Finance really shines, offering complete portfolio customization and an interactive user experience not found elsewhere.

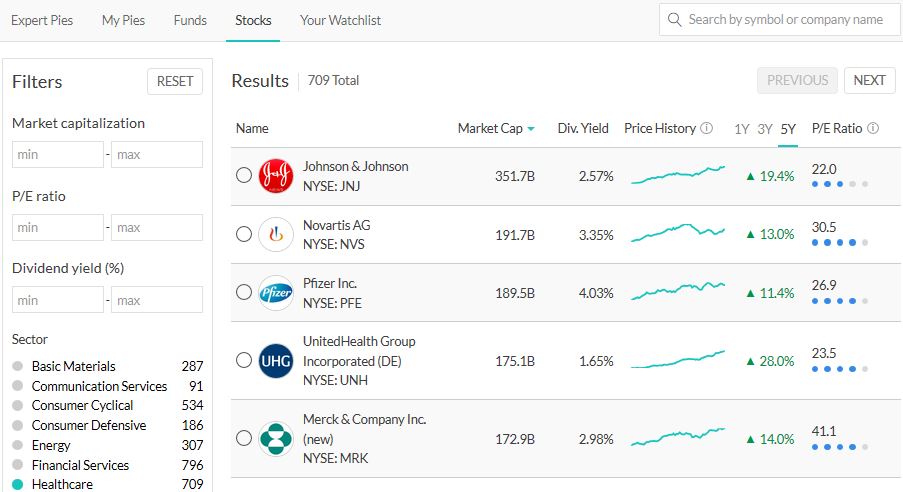

To create a custom pie, you can search for stocks and ETFs using a wide range of criteria. You can search by ticker symbol, company name, total assets, P/E ratio, dividend yield, and expense ratio.

You can also browse fund categories, including stocks, bonds, commodities, currency, and alternatives. Each asset category is further broken down by geographical location, industry, and sector.

After selecting/creating each pie, you then specify the percentage of each pie that you would like included in your overall portfolio.

Your portfolio can include up to 100 different pies (and each pie can contain up to 100 securities). That means it’s possible to include up to 1,000 different securities in your portfolio.

Step 3) Choose your account

M1 Finance offers the following account options (only available to current U.S. residents with a valid U.S address):

- Individual and joint brokerage accounts

- Traditional, Roth and SEP-IRA accounts

- Revocable and irrevocable trust accounts

- Brokerage accounts for corporations, LLCs, or partnerships

You can rollover an existing retirement plan (401k, 403b, etc.) into an IRA as well.

Step 4) Complete your profile

To finalize your account, you must provide your name, address, date of birth, and SSN. All U.S. financial institutions must collect this information as part of the Patriot Act.

You must also provide basic financial information (income, assets, and prior investment experience) to satisfy the SEC’s “know your customer” regulatory rules.

M1 Finance requires you to answer the questions required by these regulations, but nothing more.

Step 5) Fund your account

In the final step of account creation, you can link your existing bank account directly into your M1 Finance account using Plaid (a third-party that provides encrypted identity verification services for banks and financial institutions). Most U.S. banks are fully supported, allowing you to connect your banking credentials through the secure M1 interface.

After linking your bank account, you can initiate direct transfers into (and out of) your M1 investment account at any time. It’s worth noting that M1 is more liquid than most investment platforms. For most bank transfers, funds are available by the next business day, whereas most platforms require a three-day wait.

The minimum required investment is $100, but you can choose to skip this step if you would like to explore M1 without funding your account.

When you make your first deposit, M1 will automatically purchase your chosen investments in correct proportions. M1 uses fractional shares to buy the exact amount of each security so that every penny gets put to use. You will never have excess cash sitting in your M1 Finance account.

Also note, you can transfer an existing brokerage account into M1 (something called an ACATS transfer). To initiate the transfer, email the M1 team (acats@m1finance.com) to request a transfer form and include your most recent brokerage statement. The process takes 5-7 business days to complete.

Managing and Rebalancing Your M1 Finance Portfolio

After completing the steps listed above, you will have successfully established your customized M1 Portfolio.

Once the portfolio is established, the M1 Finance algorithm begins to work. There are different algorithm parameters established for portfolio contributions, withdrawals, and modifications.

To illustrate, I created a model portfolio comprised of four diversified Vanguard ETFs and a custom energy pie. The energy pie includes two individual energy stocks. We will use this portfolio in the following section to demonstrate the M1 software.

Contributions

Whenever the cash balance in your M1 account exceeds $10 (whether through bank deposits or dividends received), it will be invested during the next trading window. If your cash balance is less than $10, it will remain as cash until reaching the $10 threshold.

The trading window is the specified time when M1 makes all trades for all user accounts. M1’s trading window opens at 9am central time, every day the financial markets are open (strictly once per day). All orders placed before 9am are executed the same day.

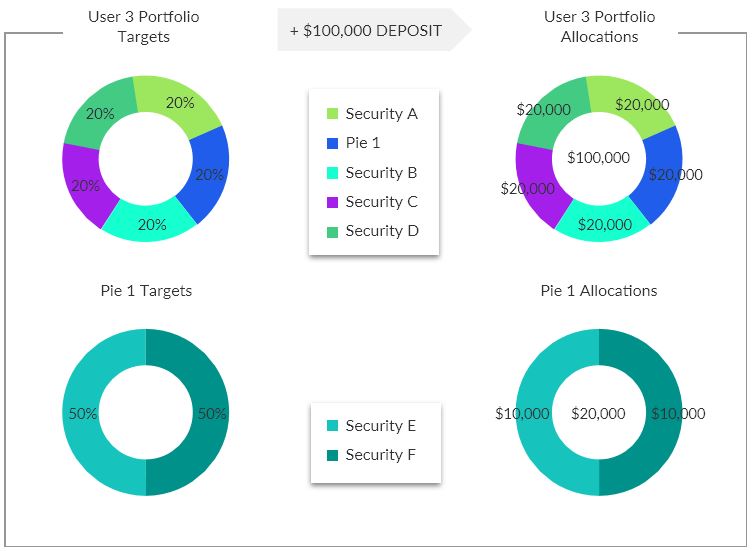

Let’s demonstrate how this works using our example portfolio. Suppose we deploy $100,000 as our initial deposit. The $100,000 would be evenly divided among the five investments in the portfolio.

M1 would automatically purchase $20,000 of each slice. For the energy pie, the $20,000 investment would be evenly divided among the two individual stocks ($10,000 in each).

Over time, the asset allocation of the portfolio will likely change because some of the assets will perform very well, while others might struggle. The M1 Finance platform will use any cash contributions to automatically invest in the underperforming asset. This keeps the portfolio asset allocation in line with your original investment strategy.

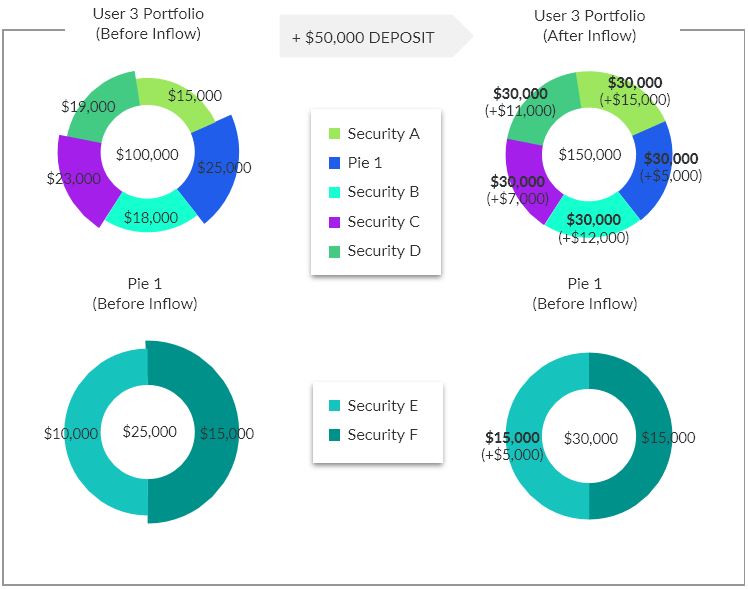

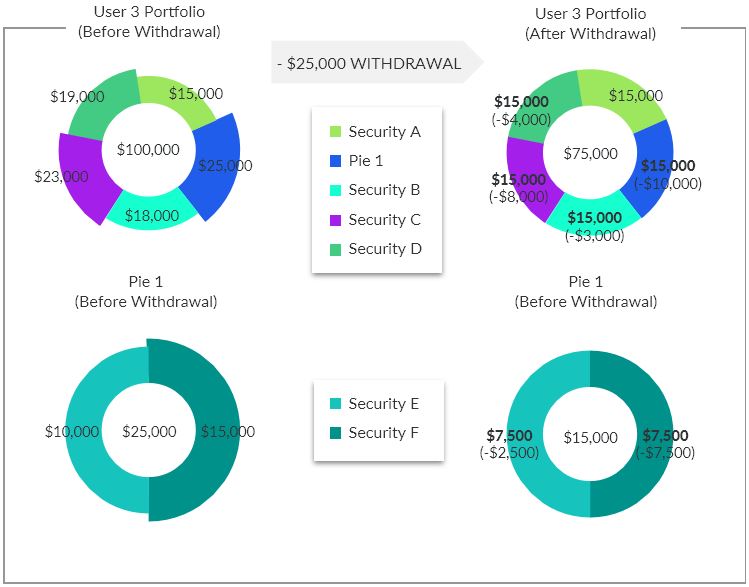

Continuing with our example, suppose the asset allocation of the portfolio has changed since our initial deposit. Suppose we invest another $50,000 into the portfolio (beyond our $100,000 initial investment).

M1 Finance will use the contribution to automatically purchase the underweight assets, bringing the portfolio back in line with the target asset allocation.

This is entire process is automated, and M1 will never sell securities on a cash inflow. This prevents unnecessary taxation while maintaining your target asset allocation.

Withdrawals

When you request a withdrawal, the M1 platform will automatically sell the most overweight slices of your portfolio to help maintain your desired asset allocation. M1 will never buy securities on a cash outflow.

Continuing with our example, let’s withdraw $25,000 from our initial $100,000 investment.

M1 Finance will automatically sell shares of each overweight asset class to bring the portfolio back to the target asset allocation.

Most brokerages use a “first in, first out” (FIFO) approach to selling. The shares that were purchased first are also the first to be sold. This is not the most tax-efficient strategy.

M1 uses a different approach to selling to help minimize your tax liability. For each security in your investment portfolio, M1 finance creates the most efficient sale strategy.

- First, M1 sells any positions that will result in no taxable gain.

- Second, M1 sells any positions that result in long-term capital gains

- As a last resort, M1 sells the positions that result in short-term capital gains

Modifying Your Portfolio

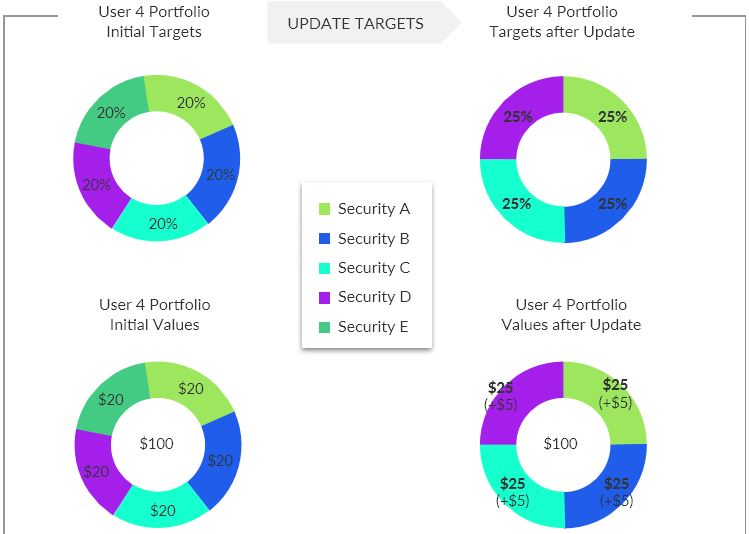

Once you have established your desired investment portfolio, the asset allocation remains the same until specific changes are made by you. M1 Finance does not automatically rebalance on your behalf.

Changing your desired asset allocation or adding additional investment slices does not cause any trades to occur. These changes are implemented using any future deposits or withdrawals, as described in the previous two sections. This reduces the number of taxable events in your account.

If you want the changes to be implemented immediately, you can manually rebalance the portfolio by logging into your account. You are able to rebalance Pie-by-Pie or you can choose to rebalance your entire portfolio. There are no limitations surrounding the number of times that you can rebalance.

When you rebalance, any overweight positions will be sold and the proceeds will be used to purchase underweight securities. You are responsible for any tax liability, and M1 Finance provides all relevant tax documents that you will need when filing your taxes.

There is one important caveat to this rule. If one of your existing investments (with a dollar value greater than zero) is set to a 0% target allocation, an automatic rebalance will occur during the next trading window. The security (or pie) will be immediately liquidated in full, and the proceeds will be invested according to your specified target portfolio.

Suppose we remove one of the ETFs from our example portfolio (change the target allocation to 0%), leaving four investments.

The change will trigger an automatic sale of the ETF, and the proceeds will be distributed evenly among the remaining four investments.

Compared to other automated investment solutions, M1 Finance provides a lot of flexibility in managing the portfolio. Investors can select any combination of securities, and then decide when to rebalance the portfolio.

M1 Finance Fees

M1 Finance charges nothing to provide all of the services mentioned in my review. The entire platform is free for individual investors. There are no trading commissions, no account maintenance fees, and no charges for deposits or withdrawals.

The only potential fees apply to unique transactions. For example, if you open a retirement account at M1 Finance and later decide to close the account, a $100 account termination fee is imposed (this is standard at brokerage firms). And there are potential fees if you request paper statements or wire transfers, as detailed in the complete fee schedule found here.

I’m sure you’re wondering how M1 manages to provide such a robust investment platform without charging fees. Their CEO has stated that they intend to add paid features in the future, as well as generate revenue through brokerage services in a recent quote:

“As a business, we need revenue to serve our customers and grow. Fortunately, in our industry, there’s no shortage of ways to make money outside of charging for services. In fact, the largest public brokerages typically only make 10-30% of their revenue from the commissions they charge. The majority comes from other services the brokerage provides.

Brokerages make money via lending securities they hold, interest on cash held in a brokerage account, extending credit through margin to customers, and getting paid for distributing certain funds or to transact on various exchanges. These revenue streams are more than enough to support a strong, vibrant company.

This is also true at M1, and we will make more money from these transactions and holding the assets than we would from our fee. The number one driver of M1’s success over time will be the number of users and assets managed. If going free puts M1 in more people’s hands and empowers them to manage more of their money on the platform, the move to free is a win-win.”

M1 Finance Security

M1 Finance includes all of the latest security features offered by commercial financial institutions, including:

- 256-bit SSL Encryption: The entire M1 platform utilizes 256-bit SSL data encryption.

- Third Party Custodian: Your assets are held at a third-party custodian named Apex Clearing. M1 Finance cannot access your money, other than to receive the agreed upon advisory fee. You are the only one who can deposit into, or withdraw from your account.

- Regulatory Oversight: M1 Finance is a registered broker/dealer with FINRA, and subject to numerous types of regulation and oversight.

- SIPC Insurance: Your account is protected by SIPC insurance. This insurance covers up to $500,000 per account in the case of fraud or mismanagement. Brokerage accounts and IRA accounts are separate accounts, each providing $500,000 of insurance on securities and up to $250,000 in cash.

M1 Finance Review Summary

After reading this review, you may be wondering if M1 Finance is the best solution for you. The answer depends on your investment needs.

Existing robo-advisors are designed for investors who don’t want to manage any part of their investment portfolio. M1 Finance offers a similar hands-off approach through the professionally designed pies that are available. The primary difference is the number of features and the level of customization.

Quality robo-advisors like Wealthfront and Betterment offer advanced tax-loss harvesting, goal-based financial planning, and other features not found at M1 Finance. These platforms charge 0.25% of the account balance annually, regardless of account size.

But M1 Finance offers a level of portfolio customization that is unmatched by competitors.

Consider someone who wants to create a diversified ETF portfolio (the standard robo-advisor offering), while also selecting individual stocks over time. This investor could use one of the M1 professional pies for baseline ETF exposure. Over time, additional pies could be created using individual stocks. Perhaps the investor wants to create a pie comprised of dividend-paying stocks, another pie comprised of energy stocks, and another pie comprised of micro-cap stocks. The possibilities are endless through M1 Finance.

Furthermore, using individual stocks at M1 Finance will result in cost savings when compared to other robo-advisors. Investors can recreate index portfolios using individual stocks, eliminating the annual ETF expenses (which average roughly 0.10% annually at Betterment/Wealthfront). These cost savings extend to underlying management fees because Betterment and Wealthfront charge 0.25% annually while M1 Finance is entirely free.

And because M1 doesn’t charge any trading commissions, an active investor can make an unlimited number of portfolio changes without incurring any additional fees or commissions. This allows M1 Finance to out-compete discount brokers who charge commissions to buy or sell a security.

In conclusion, M1 Finance offers outlandish value for a free service. I can confidently say that there is nothing else remotely comparable on the market today. If you are looking for a robust investment platform that will allow you to create a diversified, low-cost portfolio, you’d be a fool to overlook M1 Finance.