Your personal saving rate is an important financial calculation, providing valuable information about how you choose to spend or save your income over time. Furthermore, your personal saving rate is one of the most important factors in determining how long it will take to achieve financial freedom.

Although the average saving rate in America hovers around 5%, our minimalistic lifestyle allows us to save more than 80% of our income each year. The optimal saving rate will vary for every household according to needs, wishes, and consumer preferences.

Because financial freedom represents our primary financial goal, I’ve calculated our personal saving rate using numerous different methods over the past five years. Some of my efforts have been valuable, while others have been a complete waste of time. This article will summarize my findings and the important lessons that I’ve learned along the way.

What is a Personal Saving Rate?

Saving is the process of spending less money than you earn. Mathematically, your financial savings can be calculated using two variables: your income (how much money you earn) and your expenses (how much money you spend).

- Income – Expenses = Savings

A saving rate goes one step further by expressing savings as a function of income:

- Savings / Income = Saving Rate

Combining both statements above, we can derive a simplified personal saving rate calculation:

- (Income – Expenses) / Income = Saving Rate

Intuitively, your personal saving rate is the percentage of income being saved over a defined period of time (usually monthly or annually). To increase your saving rate, you must increase your income and/or decrease your expenses. This is a universal financial fact.

A Few Caveats

Timing – The saving rate equation is defined over a specific period of time, such as monthly or annually. To find a monthly personal saving rate, you would input monthly income and expenses into this equation. For annual calculations, substitute annual income and expenses.

Income – When calculating income, you must always remember to include all sources of income, not just what is observed on your monthly paycheck. For example, if you participate in a 401(k) defined contribution plan at work, you can defer a percentage of your income to reduce your annual income tax liability. In doing so, your monthly paycheck will be reduced by the amount you defer, but it’s still considered income. Additionally, if your employer offers a matching 401(k) contribution on your behalf, that is also considered income and should be included in the equation shown above. Any form of compensation should be included in the numerator and denominator of the personal saving rate calculation.

Taxation – There is disagreement about the proper way to handle the taxation of income within personal savings. Some people prefer to use gross annual income, while others favor after-tax income. There is some rationale for each position, but I prefer after-tax income because it represents disposable income (money that is readily available for saving or spending). In the end, it doesn’t really matter which you prefer, because it’s extremely easy to substitute gross/after-tax income within the saving rate equation and the interpretation remains largely unchanged.

Does Your Saving Rate Matter?

One of my favorite ways to illustrate the importance of the saving rate calculation is through the following thought experiment:

- If you save 5% of your income, you can take 1 year off for every 19 years worked.

- If you save 10% of your income, you can take 1 year off for every 9 years worked.

- If you save 20% of your income, you can take 1 year off for every 4 years worked.

- If you save 50% of your income, you can take 1 year off for every 1 year worked.

- If you save 80% of your income, you can take 4 years off for every 1 year worked.

- If you save 90% of your income, you can take 9 years off for every 1 year worked.

- If you save 95% of your income, you can take 19 years off for every 1 year worked.

These observational statements are so simple (yes, they ignore the time value of money), yet so profound. I often reflect upon this intimate work-savings-freedom relationship when I’m evaluating a potential purchase or looking to modify one of our existing financial habits.

How to Calculate Your Personal Saving Rate

As I mentioned in the intro, I’ve calculated our personal saving rate using a variety of different methods. I’ve created, tested and explored various spreadsheets, calculators, and online tools. I’ve also read dozens of articles exploring the subject in detail.

What I’ve found is that there is no consensus on the best way to calculate and track your saving rate. Like most financial topics discussed on the internet, there are individuals SCREAMING IN ALL CAPS about their preferred methodology, but that doesn’t mean they are right. And even if they are technically correct, it doesn’t mean their preferred methods will work for everyone.

After five years of experimentation, I’m no longer interested in maintaining elaborate spreadsheets or sophisticated calculations. I’m no longer interested in wasting hours of my time to achieve pinpoint accuracy within our personal saving rate. To be completely honest, I’m not sure if pinpoint accuracy even matters because the primary purpose of a saving rate calculation is to observe and evaluate the relationship between income, expenses, and savings, over time.

There is very little value in running the numbers once and concluding that you are a super-spender or super-saver. All financial calculations, including the saving rate, are a snapshot of your financial situation at a single point in time. The more important task is using the saving rate calculation to better understand your financial behaviors so that you can modify your lifestyle in a meaningful way.

The Simplist Method is the Best Method

As of 2018, I no longer calculate our personal saving rate manually. We now prefer using Personal Capital (see my detailed review) to track all income and expenses, which remember, are the required inputs when calculating a personal saving rate.

Let me demonstrate how this works:

1) Create a free Personal Capital account

Personal Capital is a powerful (free) tool that allows you to organize all of your financial information (bank accounts, investment accounts, credit cards, loans, etc.) into one online dashboard. After creating a free account, you must authorize and securely sync each financial account within your Personal Capital dashboard. After doing so, you will be presented with useful data and colorful graphs that summarize your income, expenses, investments, net worth, and much more.

2) Verify your income and expenses

After syncing each of your financial accounts to your Personal Capital account, you can view your income, expenses, and cash flow (income minus expenses) in real time. Every paycheck, retirement contribution, and credit card swipe will be reflected in your Personal Capital dashboard.

Notice how convenient this is with respect to the personal saving rate calculation? Personal Capital is doing all of the work for us here, summarizing all income and expenses in real time. Even better, you can select any time period that you desire, such as weekly, monthly, or annually.

To review this information, log into Personal Capital and navigate to the “Banking” section, where you will find the “cash flow” tool shown in my screenshot below.

Recall caveat #3 mentioned in the previous section above – which deals with taxation of income within the savings rate calculation. Specifically, whether income should be defined as gross income or after-tax income.

The income numbers provided by Personal Capital reflect after-tax pay (assuming income taxes are withheld from your paycheck) across any connected bank accounts, but fail to recognize retirement contributions (including employee deferrals and employer matches). I’ll address this in the section below.

If you think Personal Capital is missing financial information that might impact your saving rate, or if you would prefer to use other income metrics in the calculation, there is a simple solution. Use the official numbers reported on your annual tax return corresponding to gross or after-tax income.

3) Finalize your saving rate calculation

There is just one thing left to do – we need to include all retirement contributions as income in the saving rate calculation.

The “Banking – Cash Flow” section described above excludes retirement contributions, but here again, Personal Capital has made things easy. Simply navigate to the “Overview” tab, then “Transactions.”

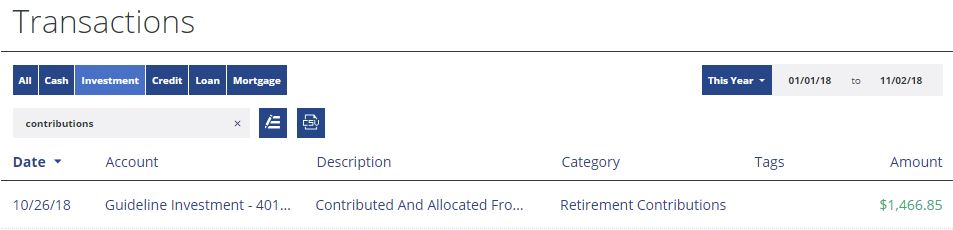

This section includes all transactions logged by Personal Capital. Here, we need to sort through things by selecting “investments” and then typing “contributions” into the search box. After doing so, Personal Capital will display all retirement contributions for each of your connected retirement accounts, as demonstrated below:

In my example, I’ve displayed a single recent 401(k) contribution. Personal Capital will display every contribution for the time period selected, and even provide the aggregate total, which is required to finalize the saving rate calculation shown below.

- (Net Income + Gross Retirement Savings – Expenses) / (Net Income + Gross Retirement Savings) = Personal Saving Rate

Make sure you are consistent in using monthly or annual data when calculating your saving rate.

4) Simplify even further

This whole process can be further simplified once you have established a fully functioning Personal Capital account that allows you to review your expenses in real time. In fact, you can replace the entire last section of content using the following process:

- Allow Personal Capital to accurately track all expenses

- Use your annual tax return to accurately assess total gross income, tax liabilities, and total retirement contributions.

This is our exact approach today. I check our personal saving rate once per year after finalizing our annual tax return, often substituting total gross income with after-tax income just for the sake of comparison.

The Cash Cow Takeaway

Don’t get lost in the details or worry about making a mistake when calculating your personal saving rate. This is not a precise science.

Choose a method that works for you, and remain consistent in your chosen methodology. In doing so, you will collect valuable financial data that will allow you to better understand your money management habits, which in turn, will allow you to pursue lifestyle modifications that increase (or decrease) your saving rate over time.

I’d love to know where you currently stand. Do you calculate your personal saving rate? How much of your income do you save each year? And most importantly, how has your saving rate changed over time?